Comparison Summary

| Feature | Tata Neu Plus Sbi Card | Tata Neu Plus Hdfc Card |

|---|---|---|

| Card Image |

|

|

| Card Network | RuPay, Visa | RuPay |

| USP | The Tata Neu SBI Plus Credit Card offers up to 7% NeuCoins on Tata Neu app and partner brand spends, plus 1% rewards on other retail and UPI transactions, making it perfect for regular Tata shoppers and digital payers. It also provides 4 complimentary domestic lounge visits annually, catering to moderate travelers seeking valuable rewards and convenience. | The Tata Neu Plus HDFC Bank Credit Card delivers accelerated NeuCoins rewards on Tata brand and Tata Neu app spends, coupled with fuel surcharge waivers and exclusive domestic lounge access, making it ideal for Tata loyalists and lifestyle-focused shoppers. |

| Annual Fee | 499 - + Applicable Taxes | 499 - + Applicable Taxes |

| Joining Fee | 499 - + Applicable Taxes | 499 - + Applicable Taxes (No Joining Fee For Select Users) |

| Welcome Benefits | Get 499 NeuCoins only on payment of Rs. 499 Joining Fee | Get 499 NeuCoins only on payment of Rs. 499 Joining Fee |

| Lounge Access | Domestic: 1 per quarter On spends of ₹50,000+ in the last 3 months |

Domestic: 1 per quarter On spends of ₹50,000+ in the last 3 months |

| Reward Rate | Earn 7% NeuCoins on Tata Neu app and partner Tata brands, 2% on other Tata brand spends, and 1% on all other spends including UPI (with monthly caps on some categories) | Earn 2% NeuCoins on Tata Neu and Tata brand spends, 1% NeuCoins on other transactions including UPI (with monthly cap), plus an extra 5% NeuCoins on select Tata Neu categories with Tata NeuPass membership. |

| Interest Rate | Finance charges are 3.75% per month on outstanding balances | 3.6% per month (43.20% per annum) on revolving credit and cash advances |

| Best For | Online Shopping, UPI | UPI |

| Apply Now | Apply Now | Apply Now |

Fees & Charges: Tata Neu Plus SBI vs Tata Neu Plus HDFC

| Fee Type | Tata Neu Plus SBI | Tata Neu Plus HDFC |

|---|---|---|

| Annual / Joining Fee | ₹499 + GST | ₹499 + GST |

| Fee Waiver Condition | Spend ₹1 lakh/year | Spend ₹1 lakh/year |

| Add-on Card Fee | Nil | Nil |

| Foreign Currency Markup | 3.5% | 3.5% |

Both Tata Neu Plus SBI and Tata Neu Plus HDFC cards charge a ₹499 + GST annual and joining fee, which is fully waived by spending ₹1 lakh in a card anniversary year. There are no add-on card fees for either option, making supplementary cards free. For international transactions, each card applies a 3.5% foreign currency markup, so foreign purchases incur extra charges. There are no hidden special charges or additional surcharges beyond standard rates for these entry-level Tata Neu Plus co-branded cards

Welcome Benefits & Eligibility: Tata Neu Plus SBI vs Tata Neu Plus HDFC

Both Tata Neu Plus SBI and Tata Neu Plus HDFC cards offer a 499 NeuCoins welcome gift credited after activation and first spend. This bonus matches the ₹499 joining fee, effectively making the card free for the first year if welcome NeuCoins are redeemed.

Eligibility criteria include being an Indian resident, aged 18 to 65 years, and having a good credit history, ideally a CIBIL score of 700+. Income documents and PAN/Aadhaar are required at the time of application, but specific salary criteria are not publicly stated for either issuer.

The application process is quick online via Tata Neu App, HDFC or SBI websites—typically requiring basic KYC, digital onboarding, and instant status updates. Most applicants get approval in a few days unless further verification is needed.

Key sign-up bonus: Both cards give 499 NeuCoins (worth ₹499) on activation. Eligibility: Indian resident, age 18-65, good CIBIL, standard KYC. Apply online for fast digital approval and instant updates.

Lounge Access: Tata Neu Plus SBI vs Tata Neu Plus HDFC

| Feature | Tata Neu Plus SBI | Tata Neu Plus HDFC |

|---|---|---|

| Number of Lounge Visits | 4/year | 4/year |

| Spend Condition for Access | ₹50,000 in previous quarter | ₹50,000 in previous quarter |

| Lounge Voucher Claim Process | Via SMS/email within 30 working days | Via SMS/email within 30 working days |

Both the Tata Neu Plus SBI and Tata Neu Plus HDFC cards offer 4 complimentary domestic airport lounge visits per year. To avail these free lounge visits, cardholders must meet a spend-based condition. Both cards require a minimum spend of ₹50,000 in the previous quarter (3 months) to unlock lounge access for the following quarter. This means you need to spend ₹50,000 every 3 months to continue enjoying this perk.

No international lounge access is provided with either card at the Plus level. Lounge access via direct swipe is discontinued; instead, eligible cardholders receive lounge access vouchers via SMS or email, which need to be claimed within a limited time.

Cashback & Rewards Structure: Tata Neu Plus SBI vs Tata Neu Plus HDFC

| Reward Category | Tata Neu Plus SBI | Tata Neu Plus HDFC |

|---|---|---|

| Tata Neu App/Website & Tata Partner Brands | 2% NeuCoins | 2% NeuCoins |

| Select Categories on Tata Neu App/Website (NeuPass) | Extra 5% NeuCoins | Extra 5% NeuCoins |

| Other Eligible Transactions (including UPI) | 1% NeuCoins | 1% NeuCoins |

| UPI Transactions (RuPay card) | 1% NeuCoins (capped at 500 NeuCoins/month) | 1% NeuCoins (capped at 500 NeuCoins/month) |

| Maximum Reward Caps | Capping on grocery, insurance, utilities, telecom, and UPI spends | Same reward capping as SBI card |

| NeuCoin Redemption Value | 1 NeuCoin = ₹1 (redeemable on Tata Neu app) | 1 NeuCoin = ₹1 (redeemable on Tata Neu app) |

Both Tata Neu Plus SBI and Tata Neu Plus HDFC cards offer rewards in the form of NeuCoins, which are redeemable at Tata brands with a value of 1 NeuCoin = ₹1. On spends made via the Tata Neu App and Tata partner brands, cardholders earn 2% NeuCoins. Select categories under Tata NeuPass on the app/website provide an additional 5% NeuCoins, making those spends highly rewarding.

For all other eligible transactions, including UPI payments via RuPay, both cards credit 1% NeuCoins, with a monthly cap of 500 NeuCoins on UPI spends. Reward capping applies to grocery, insurance, utility, telecom transactions, and UPI transactions, limiting the monthly NeuCoins earned in these categories.

The reward accrual method rounds down fractional NeuCoins, and redemptions are seamless via the Tata Neu app across various brands like BigBasket, Air India, Westside, Tata CliQ, and more. Overall, the cashback and rewards structure of both cards is identical and optimized for Tata ecosystem shoppers

Cashback & Rewards Redemption: Tata Neu Plus SBI vs Tata Neu Plus HDFC

Both the Tata Neu Plus SBI and Tata Neu Plus HDFC cards allow for easy redemption of NeuCoins, the cashback currency earned on spends. NeuCoins can be redeemed for purchases only via the Tata Neu App or Website, usable across eligible Tata brands like BigBasket, Croma, Westside, Air India Express, Tata CLiQ, and more.

NeuCoins are credited to the cardholder’s Tata Neu account within 7 working days after statement generation. The value of NeuCoins is straightforward: 1 NeuCoin = ₹1 in savings, redeemable as payment on listed partner platforms. There is no cashback credited as statement or bank account credits; redemption exclusively happens as rewards spend inside the Tata ecosystem.

To redeem, users select NeuCoins as a payment method during checkout on the Tata Neu platform. Offline redemptions may be available at select stores but usually require prior arrangement or knowing partner terms.

NeuCoins have a validity of 12 months from the month of credit. Any unused points after this period will expire, so periodic redemption is recommended.

In summary, both SBI and HDFC variants share the same redemption mechanics—flexible for Tata shoppers but limited strictly to Tata ecosystem spending with no direct cash or statement credits.

Frequently Asked Questions (FAQs) for Tata Neu Plus SBI vs Tata Neu Plus HDFC

Are the Tata Neu Plus SBI and HDFC cards lifetime free?

Both cards have a ₹499 joining and annual fee, but the fee is waived on spending ₹1 lakh in a year. Lifetime free offers were available temporarily in 2024 but ended after December 31, 2024.

How can I redeem cashback/NeuCoins earned on these cards?

Do these cards offer lounge access? If yes, how many visits and what are the conditions?

Both cards provide 4 domestic lounge visits annually, with a ₹50,000 quarterly spend requirement to qualify for the next quarter’s lounge access. Lounge access is via vouchers sent by SMS or email.

How to maximize rewards on Tata Neu Plus SBI and HDFC cards?

Conclusion: Tata Neu Plus SBI vs Tata Neu Plus HDFC Credit Cards

Both Tata Neu Plus SBI and Tata Neu Plus HDFC credit cards deliver nearly identical value, rewards, fees, and benefits, making them excellent options for regular Tata ecosystem shoppers. With a ₹499 annual fee waiver on ₹1 lakh yearly spend, the cards are affordable and yield steady NeuCoin rewards on Tata Neu app spends and partner brands.

The lounge access benefit of 4 domestic visits per year adds value for frequent flyers, though it requires a ₹50,000 quarterly spend threshold on both cards. Redemption of cashback is seamless but limited to Tata Neu app/website, so these cards suit users loyal to Tata brands.

Choosing between SBI and HDFC Tata Neu Plus largely depends on individual preference, bank relationship, or ease of application. HDFC cards sometimes offer better first-year fee waivers or promotional offers, while SBI cards may have wider availability for existing SBI customers.

Overall, for those invested in the Tata ecosystem, both credit cards provide meaningful cashback, easy fee waivers, and useful lifestyle benefits without unnecessary complexity. They are well-suited for shoppers who want to maximize value simply by using Tata Neu and associated brands regularly.

You might also be interested in:

Latest Blogs

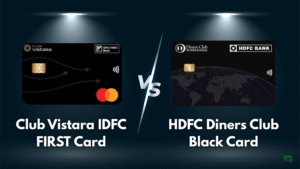

Club Vistara IDFC FIRST vs HDFC Diners Club Black Credit Card Comparison

Club Vistara IDFC FIRST vs HDFC Diners Club Black Credit Card Comparison

IDFC FIRST WOW vs Tata Neu Plus SBI Card: Best Pick?

IDFC FIRST WOW vs Tata Neu Plus SBI Card: Best Pick?

HDFC Regalia Gold vs Tata Neu Plus: Which Card Wins?

HDFC Regalia Gold vs Tata Neu Plus: Which Card Wins?

ICICI Sapphiro vs Axis Reserve Credit Card: Which Premium Card Wins?

ICICI Sapphiro vs Axis Reserve Credit Card: Which Premium Card Wins?

IndiGo Kotak XL vs IndiGo Kotak Credit Card

IndiGo Kotak XL vs IndiGo Kotak Credit Card

Airtel Axis Bank Credit Card vs Flipkart Axis Bank Credit Card: Which Cashback Card is Best in 2025?

Airtel Axis Bank Credit Card vs Flipkart Axis Bank Credit Card: Which Cashback Card is Best in 2025?