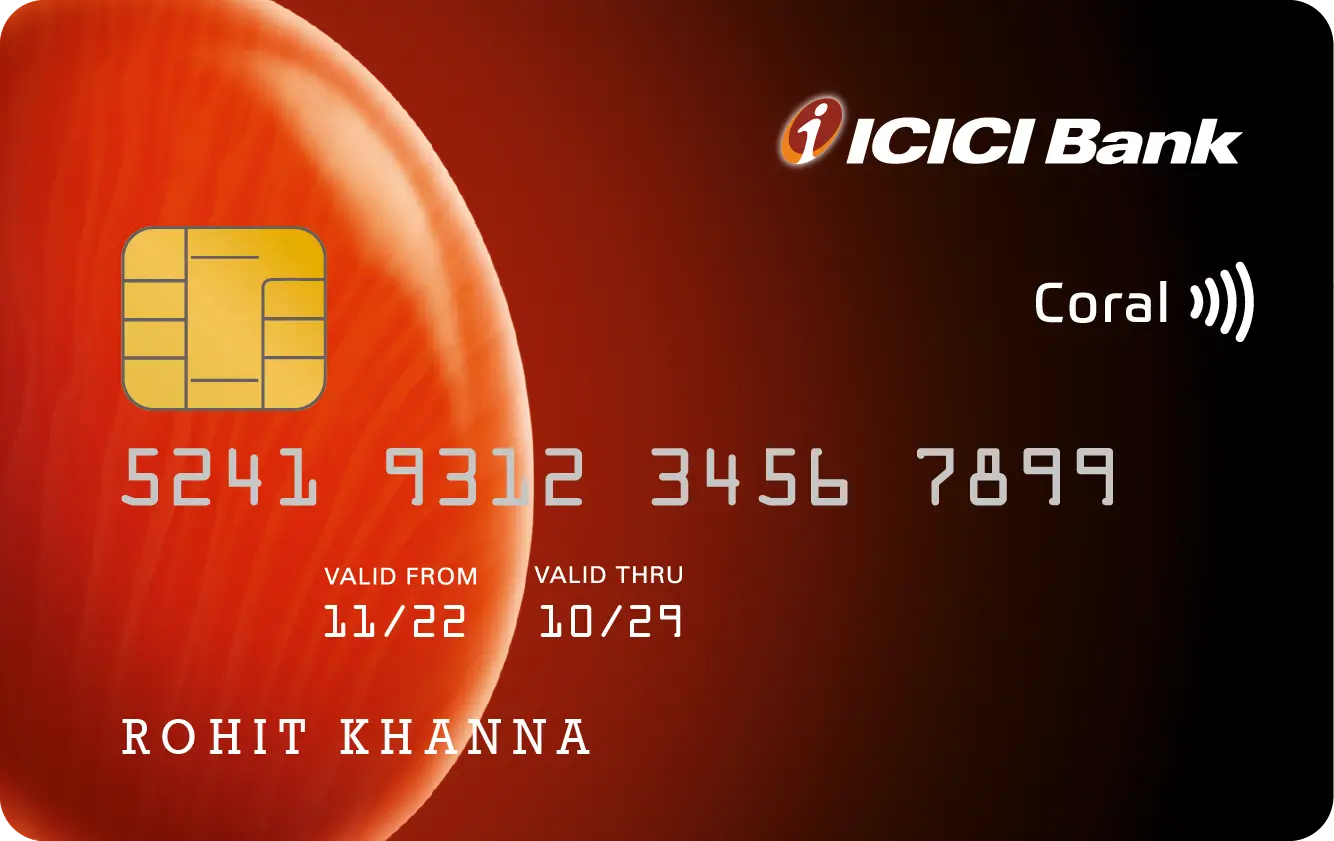

ICICI Bank Coral Credit Card

The ICICI Bank Coral Credit Card delivers 2% rewards on retail spends, quarterly domestic lounge access, movie ticket discounts, and fuel surcharge waivers, making it perfect for everyday shoppers seeking lifestyle benefits at an affordable annual fee.

Apply Now ❯2% Rewards

Earn 2 Reward Points per ₹100 on all retail purchases with no category restrictions or spending caps.

Lounge Access

Get 1 complimentary domestic airport lounge visit every quarter plus 4 annual railway lounge accesses.

Annual Fee Waiver

Annual fee of ₹500 waived on spending just ₹1,50,000 in a year

| Feature | Details |

|---|---|

| Bank / Issuer | ICICI Bank |

| Card Type | Mastercard, Visa |

| Joining Fee | 500 Plus GST |

| Annual Fee | 500 Plus GST |

| Welcome Benefits | 2,000 Reward Points on spending ₹2,00,000 in the first year under Milestone Rewards |

| Fee Waiver Condition | Annual fee of ₹500 is waived if you spend ₹1,50,000 or more in the card membership year |

| Reward Rates | Earn 2 Reward Points per ₹100 on retail spend (2% return) and 1 Reward Point per ₹100 on utilities and insurance (1% return). Get 6x to 12x points on iShop portal. Milestone bonus: 2,000 points at ₹2L spend, then 1,000 points per ₹1L thereafter (max 10,000 points/year) |

| Eligibility Criteria (Salary) | 240000 |

| Eligibility Criteria (Self-Employed) | 240000 |

| Interest Rates | 3.75% per month (45% per annum) |

| Foreign Exchange Markup | 3.5% on all international transactions |

| Best For | Lounge Access, Movies |

| Lounge Access | Domestic: 1 per quarter |

Key Features & Benefits

The ICICI Bank Coral Credit Card transforms everyday spending into rewarding experiences with its generous reward structure and lifestyle perks. You earn 2 Reward Points on every ₹100 spent on retail purchases and 1 Reward Point per ₹100 on utilities and insurance payments. The card’s Milestone Rewards program sweetens the deal further—spend ₹2,00,000 in your anniversary year and receive 2,000 bonus points, followed by 1,000 points for every additional ₹1,00,000 spent, capping at 10,000 bonus points annually.

Beyond rewards, cardholders enjoy quarterly domestic airport lounge access and 4 complimentary railway lounge visits per year, making travel more comfortable. Entertainment lovers benefit from twice-monthly movie ticket discounts on BookMyShow and INOX. The card also offers 1% fuel surcharge waiver on transactions between ₹400 and ₹4,000 at HPCL pumps when you pay at least the minimum due amount.

For online shoppers, the iShop portal delivers accelerated earnings with 6x to 12x reward points on select purchases. With a reasonable annual fee of just ₹500 plus GST (waived on spending ₹1.5 lakh), the ICICI Coral Credit Card provides exceptional value for individuals seeking a balanced mix of rewards, travel comfort, and entertainment benefits.

All You Need to Know About: ICICI Bank Coral Credit Card

The ICICI Bank Coral Credit Card is a mid-tier lifestyle credit card designed for individuals seeking a balanced mix of rewards, travel benefits, and entertainment perks without paying premium card fees. Issued by ICICI Bank Limited on Visa or Mastercard networks, this card caters to young professionals, middle-income earners, and first-time premium cardholders with accessible eligibility criteria requiring just ₹20,000 monthly income for salaried individuals or ₹2,40,000 annual income for self-employed applicants.

The card’s reward program is straightforward and rewarding—earn 2 Reward Points on every ₹100 spent on retail purchases including dining, shopping, groceries, and online orders, effectively delivering a 2% return on spending. For utility bills and insurance premium payments, you earn 1 Reward Point per ₹100 spent. The Milestone Rewards program adds significant value by offering 2,000 bonus points when you spend ₹2,00,000 in your anniversary year, followed by 1,000 bonus points for every additional ₹1,00,000 spent thereafter, with a maximum cap of 10,000 milestone bonus points per year. For online shoppers, the iShop portal accelerates earnings with 6x to 12x reward points on select purchases from partner merchants.

Travel comfort is a key highlight with quarterly domestic airport lounge access (1 visit per quarter, totaling 4 visits annually) and 4 complimentary railway lounge accesses per year, requiring no minimum spending to unlock these benefits. Entertainment enthusiasts benefit from twice-monthly movie ticket discounts available on BookMyShow and INOX platforms. The card also provides practical savings with a 1% fuel surcharge waiver on transactions between ₹400 and ₹4,000 at HPCL petrol pumps, applicable when minimum dues are paid on time.

The fee structure remains affordable with a joining fee of ₹500 plus GST and an annual renewal fee of ₹500 plus GST, both of which are waived entirely if you spend ₹1,50,000 or more during your card membership year—a threshold easily achievable for regular users. The interest rate stands at 3.75% per month (45% per annum) on revolving credit balances, making timely full payments essential to avoid finance charges. International transactions carry a foreign exchange markup of 3.5%, which is standard for mid-tier cards. Reward Points earned can be redeemed flexibly across movie vouchers, travel bookings, lifestyle products, mobile phones, appliances, and more through ICICI Bank’s redemption portal, ensuring your earnings translate into tangible benefits that match your preferences. With its comprehensive feature set, reasonable fees, and accessible eligibility, the ICICI Bank Coral Credit Card positions itself as an excellent choice for individuals seeking their first lifestyle-focused credit card or upgrading from basic variants.

Pros & Cons

Pros

- Earn solid 2% rewards on all retail spending with no category restrictions

- Quarterly domestic lounge access plus 4 railway lounge visits annually

- Low annual fee of ₹500 that’s waived on spending just ₹1.5 lakh

- Attractive milestone bonuses offering up to 10,000 extra points per year

- Fuel surcharge waiver and bi-weekly movie discounts add practical value

Cons

- High interest rate of 3.75% per month (45% annually) on unpaid balances

- Foreign exchange markup of 3.5% is higher than premium cards

- Reward rate on utilities and insurance is lower at 1%

- Fuel surcharge waiver limited to ₹400-₹4,000 transactions at HPCL only

How to Apply

Applying for the ICICI Bank Coral Credit Card is straightforward and can be completed online in minutes. Visit the official ICICI Bank website and navigate to the credit cards section, then select the Coral Credit Card option. Fill out the online application form with your personal details, income information, and employment status—you’ll need a minimum monthly income of ₹20,000 for salaried individuals or annual income of ₹2,40,000 for self-employed applicants. Upload required documents such as PAN card, address proof, and income proof (salary slips or ITR). Once submitted, ICICI Bank will review your application and perform a credit check. Upon approval, your card will be delivered to your registered address within 7-10 working days, ready to unlock rewards and lifestyle benefits.

Detailed Fee Structure

The ICICI Bank Coral Credit Card charges a joining fee of ₹500 plus applicable GST, with an identical annual renewal fee of ₹500 plus GST. However, the annual fee is completely waived if you spend ₹1,50,000 or more during your card membership year, making it essentially free for regular users. The card levies an interest rate of 3.75% per month (45% per annum) on revolving credit balances, so paying your bills in full is advisable to avoid finance charges.

For international transactions, a foreign exchange markup of 3.5% applies on all purchases made in foreign currency. Late payment fees range based on the outstanding amount, and overlimit charges may apply if you exceed your credit limit. Cash advance fees and GST apply on ATM withdrawals. The fuel surcharge waiver of 1% is available on transactions between ₹400 and ₹4,000 at HPCL petrol pumps, but only if you’ve paid at least the minimum due on your previous bill. There are no charges for reward point redemption, lounge access (within the quarterly limit), or adding-on family members as supplementary cardholders.

Who Should Get This Card?

The ICICI Bank Coral Credit Card is ideal for young professionals, middle-income earners, and first-time premium cardholders seeking value-driven lifestyle benefits without hefty fees. If you’re someone who spends between ₹10,000 to ₹20,000 monthly on everyday retail purchases like groceries, dining, shopping, and online orders, this card’s 2% reward rate will consistently add value. Frequent domestic travelers will appreciate the quarterly airport lounge access and annual railway lounge visits, while movie enthusiasts can save significantly with twice-monthly ticket discounts. The card also suits individuals who regularly fuel vehicles at HPCL pumps and want to save on surcharges. With its low ₹1.5 lakh annual spending threshold for fee waiver and accessible income requirement of ₹20,000 per month, the Coral Credit Card strikes a perfect balance for individuals upgrading from basic cards or seeking their first rewards-focused lifestyle card.

Alternatives & Competitor Comparison

| Feature | ICICI Bank Coral Credit Card | HDFC MoneyBack+ Credit Card |

|---|---|---|

| Card Image |  |  |

| Card Network | Mastercard, Visa | Mastercard, RuPay, Visa |

| USP | The ICICI Bank Coral Credit Card delivers 2% rewards on retail spends, quarterly domestic lounge access, movie ticket discounts, and fuel surcharge waivers, making it perfect for everyday shoppers seeking lifestyle benefits at an affordable annual fee. | The HDFC MoneyBack+ Credit Card delivers 3.3% cashback on popular platforms like Amazon, Flipkart, Swiggy, and BigBasket, making it perfect for online shoppers and digital spenders. With quarterly vouchers, RuPay UPI rewards, and an affordable ₹500 annual fee waived on ₹50,000 spend, it's an excellent entry-level card for maximizing everyday e-commerce rewards. |

| Annual Fee | 500 Plus GST | 500 Plus GST |

| Joining Fee | 500 Plus GST | 500 Plus GST |

| Welcome Benefits | 2,000 reward points on spending ₹2,00,000 in the first year under milestone rewards | 500 Cashpoints on membership fee payment (worth ₹125 as cashback) |

| Lounge Access | Domestic: 1 per quarter | N/A |

| Reward Rate | Earn 2 reward points per ₹100 on retail spend (2% return) and 1 reward Point per ₹100 on utilities and insurance (1% return). Get 6x to 12x points on iShop portal. milestone bonus: 2,000 points at ₹2L spend, then 1,000 points per ₹1L thereafter (max 10,000 points/year) | Earn 10X Cashpoints (3.3% value) on Amazon, Flipkart, Swiggy, Reliance Smart SuperStore & BigBasket—20 points per ₹150 spent, capped at 2,500 points/month. Other spends earn 2 points per ₹150 (0.33% value). RuPay UPI spends earn 2 points per ₹150, capped at 500 points/month. |

| Interest Rate | 3.75% per month (45% per annum) | 3.6% per month (43% per annum) |

| Best For | Lounge Access, Movies | Online Shopping |

| Apply Now | Apply Now | Apply Now |

Frequently Asked Questions

What is the joining fee for the ICICI Bank Coral Credit Card?

The ICICI Bank Coral Credit Card has a joining fee of ₹500 plus GST. The annual renewal fee is also ₹500 plus GST, but it's waived if you spend ₹1,50,000 or more in your card membership year.

How many reward points do I earn with the ICICI Bank Coral Credit Card?

With the ICICI Bank Coral Credit Card, you earn 2 Reward Points for every ₹100 spent on retail purchases and 1 Reward Point for every ₹100 spent on utilities and insurance. Additionally, milestone bonuses offer up to 10,000 extra points per year.

What is the lounge access benefit on the ICICI Bank Coral Credit Card?

The ICICI Bank Coral Credit Card provides 1 complimentary domestic airport lounge access every quarter (4 times per year) and 4 complimentary railway lounge accesses annually. No minimum spending is required for these benefits.

What is the minimum income required to apply for the ICICI Bank Coral Credit Card?

To apply for the ICICI Bank Coral Credit Card, salaried individuals need a minimum monthly income of ₹20,000, while self-employed or business individuals require an annual income of ₹2,40,000.

Does the ICICI Bank Coral Credit Card offer fuel surcharge waiver?

Yes, the ICICI Bank Coral Credit Card offers a 1% fuel surcharge waiver on transactions worth ₹400 to ₹4,000 at HPCL petrol pumps, provided you've paid at least the minimum amount due on your previous statement.

Final Verdict

Is the ICICI Bank Coral Credit Card right for you? If you're seeking a well-rounded lifestyle card that balances rewards, travel comfort, and entertainment perks at an affordable cost, the answer is a resounding yes. With its attractive 2% reward rate on everyday spending, quarterly lounge access, movie discounts, and fuel savings, this card delivers consistent value across multiple categories. The low annual fee of just ₹500 (easily waived on spending ₹1.5 lakh) makes it accessible even for moderate spenders, while the milestone bonus program rewards loyalty with up to 10,000 extra points annually. The accessible eligibility criteria of ₹20,000 monthly income opens doors for young professionals and first-time premium cardholders. While the interest rate and forex markup are on the higher side, responsible users who pay bills on time will find the Coral Credit Card to be an excellent companion for maximizing everyday expenses. Ready to upgrade your spending experience? Apply for the ICICI Bank Coral Credit Card today and start earning rewards on every purchase.

You might also be interested in:

Latest Blogs

Club Vistara IDFC FIRST vs HDFC Diners Club Black Credit Card Comparison

Club Vistara IDFC FIRST vs HDFC Diners Club Black Credit Card Comparison

IDFC FIRST WOW vs Tata Neu Plus SBI Card: Best Pick?

IDFC FIRST WOW vs Tata Neu Plus SBI Card: Best Pick?

HDFC Regalia Gold vs Tata Neu Plus: Which Card Wins?

HDFC Regalia Gold vs Tata Neu Plus: Which Card Wins?

ICICI Sapphiro vs Axis Reserve Credit Card: Which Premium Card Wins?

ICICI Sapphiro vs Axis Reserve Credit Card: Which Premium Card Wins?

IndiGo Kotak XL vs IndiGo Kotak Credit Card

IndiGo Kotak XL vs IndiGo Kotak Credit Card

Airtel Axis Bank Credit Card vs Flipkart Axis Bank Credit Card: Which Cashback Card is Best in 2025?

Airtel Axis Bank Credit Card vs Flipkart Axis Bank Credit Card: Which Cashback Card is Best in 2025?

Latest Comparisons

Flipkart SBI vs Axis Bank Credit Card – Best for Online Shopping Rewards?

Flipkart SBI vs Axis Bank Credit Card – Best for Online Shopping Rewards?

IDFC FIRST Select vs Federal Bank Scapia vs IndusInd Tiger – Best Lifetime Free Card?

IDFC FIRST Select vs Federal Bank Scapia vs IndusInd Tiger – Best Lifetime Free Card?

HDFC Regalia Gold vs ICICI Sapphiro vs SBI ELITE – Best Premium Card?

HDFC Regalia Gold vs ICICI Sapphiro vs SBI ELITE – Best Premium Card?

SBI SimplySAVE vs SimplyCLICK Credit Card – Best for Rewards?

SBI SimplySAVE vs SimplyCLICK Credit Card – Best for Rewards?

HDFC Millenia vs Tata Neu Plus vs Swiggy Credit Card – Best for Rewards?

HDFC Millenia vs Tata Neu Plus vs Swiggy Credit Card – Best for Rewards?

ICICI Sapphiro vs IDFC Mayura vs HDFC Diners Black – Best Premium Travel Card?

ICICI Sapphiro vs IDFC Mayura vs HDFC Diners Black – Best Premium Travel Card?