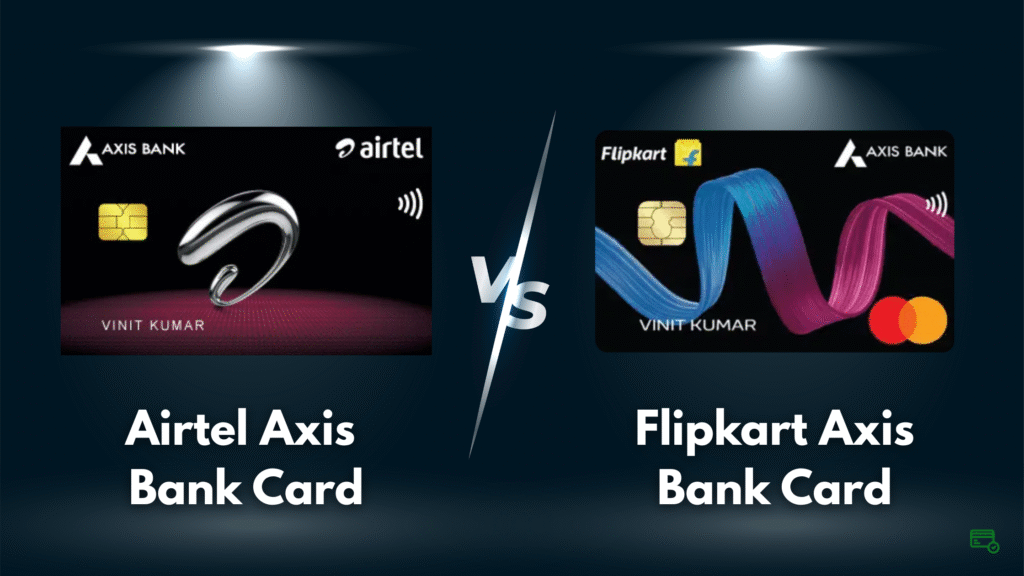

Comparison Summary

The Airtel Axis Bank Credit Card delivers 25% cashback on Airtel payments and 10% on utility bills, making it perfect for Airtel subscribers who regularly pay mobile, DTH, and broadband bills. It also offers 1 complimentary domestic lounge visit per quarter on qualifying spends. The Flipkart Axis Bank Credit Card offers 7.5% cashback on Myntra, 5% on Flipkart and Cleartrip, and 1.5% on all other online spends, ideal for frequent online shoppers. While Airtel’s card has lower income requirements and travel perks, Flipkart’s card is lifetime free for select channels and provides uncapped, higher cashback rates on e-commerce. The verdict: Choose Airtel if you’re invested in the Airtel ecosystem, pay regular bills, and travel occasionally; choose Flipkart if you shop online frequently and want premium cashback rates without annual fees.

| Feature | Airtel Axis Bank Credit Card | Flipkart Axis Bank Credit Card |

|---|---|---|

| Card Image |

|

|

| Card Network | RuPay | Mastercard, Visa |

| USP | The Airtel Axis Bank Credit Card offers up to 25% cashback on Airtel mobile, broadband, and DTH bill payments via the Airtel Thanks app, along with 10% cashback on utility bills and partner merchants like Swiggy, Zomato, and BigBasket. It also provides 1% cashback on all other spends, plus 4 complimentary domestic lounge visits per year, making it ideal for Airtel users who want maximum savings on everyday bills and dining with added travel perks. | Flipkart Axis Bank Credit Card delivers high cashback on Flipkart, Myntra, and preferred merchants, making it ideal for avid online shoppers seeking maximum savings and exclusive lifestyle rewards. |

| Annual Fee | 500 - plus GST | 500 - Lifetime free for select channels |

| Joining Fee | 500 - plus GST | 500 - Lifetime free for select channels |

| Welcome Benefits | Amazon e-voucher worth ₹500 on the first transaction within 30 days of card issuance. | ₹350 worth of activation benefits (including ₹250 Flipkart voucher on first transaction for paid cards) |

| Lounge Access | Domestic: 1 per quarter On spends of ₹50,000+ in the last 3 months |

N/A |

| Reward Rate | Earn 25% cashback on Airtel mobile, broadband, WiFi, and DTH bill payments via Airtel Thanks app (capped at ₹250/month), 10% cashback on utility bills via Airtel Thanks app (capped at ₹250/month), 10% cashback on Swiggy, Zomato, and BigBasket (capped at ₹500/month combined), and 1% unlimited cashback on all other spends including UPI on RuPay variant. | Earn 7.5% cashback on Myntra, 5% on Flipkart and Cleartrip, and 4% on Swiggy, PVR, etc, 1.5% on other online spends on all online spends & 1% on offline transactions |

| Interest Rate | 3.6% per month (52.86% per annum) | 3.6% per month (52.86% per annum) |

| Best For | Bill Payments, Food Ordering | Online Shopping |

| Apply Now | Apply Now | Apply Now |

Who Can Apply for Airtel Axis Bank vs Flipkart Axis Bank Credit Card?

Both cards are accessible entry-level options from Axis Bank, but they target slightly different income segments. The Airtel card has a lower income threshold at ₹15,000 monthly (approximately ₹1.8 lakh annually), while the Flipkart card requires ₹20,000 per month (around ₹2.4 lakh annually). Both accept salaried and self-employed applicants aged 18 to 70 years with a minimum credit score of 750+. You’ll need standard documentation: identity proof (Aadhaar, PAN), address proof, and income proof (salary slips or ITR). Applications are processed within 5-7 working days through online channels, mobile apps, or bank branches, with cards delivered in 7-10 working days post-approval.

| Eligibility Criteria | Airtel Axis Bank Card | Flipkart Axis Bank Card |

|---|---|---|

| Minimum Monthly Income (Salaried) | ₹15,000 (~₹1.8L/year) | ₹20,000 (~₹2.4L/year) |

| Minimum Credit Score | 750+ | 750+ |

| Age Range | 18-70 years | 18-70 years |

| Employment Status | Salaried/Self-employed | Salaried/Self-employed |

| Approval Timeline | 5-7 working days | 5-7 working days |

Airtel vs Flipkart Axis Bank Credit Card: Complete Fee Structure

Here’s where these cards differ significantly. The Airtel card charges ₹500 plus GST (₹590 total) for both joining and annual fees, with waiver available if you spend ₹2 lakh or more in a year. The Flipkart card, however, is lifetime free for select channels—making it an exceptional value proposition for online shoppers who apply through eligible platforms. For paid variants of the Flipkart card, fees are ₹500 plus GST with waiver at ₹3.5 lakh annual spending. Add-on cards cost ₹100 plus GST for both. Foreign currency transactions carry a 3.5% markup, cash withdrawals cost 2.5% (minimum ₹500), and late payment fees can go up to ₹500. Reward redemption is free on both cards.

| Fee Type | Airtel Axis Bank Card | Flipkart Axis Bank Card |

|---|---|---|

| Joining Fee | ₹590 (₹500 + GST) | ₹590 (₹500 + GST) – Lifetime free for select channels |

| Annual Fee | ₹590 (₹500 + GST) | ₹590 (₹500 + GST) – Lifetime free for select channels |

| Fee Waiver Condition | Spend ₹2 lakh/year | Spend ₹3.5 lakh/year (paid variant) |

| Add-on Card Fee | ₹118 (₹100 + GST) | ₹118 (₹100 + GST) |

| Foreign Currency Markup | 3.5% | 3.5% |

| Cash Withdrawal | 2.5% (min ₹500) | 2.5% (min ₹500) |

| Reward Redemption Fee | Nil | Nil |

Welcome Offers: Airtel vs Flipkart Axis Bank Credit Card

The Airtel card keeps welcome benefits straightforward: make your first transaction within 30 days of card activation and receive a ₹500 Amazon eVoucher. The Flipkart card offers ₹350 worth of activation benefits, which includes a ₹250 Flipkart voucher on first transaction for paid card variants. Both cards credit welcome benefits within 30 days of meeting the spending requirement. While Airtel doesn’t advertise milestone benefits, Flipkart occasionally runs promotional campaigns offering additional cashback or vouchers during festive seasons. Neither card offers introductory 0% APR periods, so plan to pay your bills in full to avoid interest charges at 3.6% monthly (52.86% annually) on both cards.

| Welcome Benefit | Airtel Axis Bank Card | Flipkart Axis Bank Card |

|---|---|---|

| Welcome Bonus | ₹500 Amazon eVoucher | ₹350 activation benefits (₹250 Flipkart voucher for paid cards) |

| Spend Requirement | First transaction within 30 days | First transaction within 30 days |

| Credit Timeline | Within 30 days | Within 30 days |

| Milestone Benefits | Not advertised | Occasional festive promotions |

| Introductory APR | No 0% APR offer | No 0% APR offer |

How You Earn: Airtel vs Flipkart Axis Bank Rewards Breakdown

The earning structures differ dramatically based on where you spend. Airtel’s card shines on its ecosystem: 25% cashback on Airtel payments (mobile, DTH, broadband, WiFi) capped at ₹250 per month through the Airtel Thanks app, 10% cashback on utility bills capped at ₹250 monthly via the same app, and 10% on preferred merchants like Swiggy, Zomato, and BigBasket capped at ₹500 monthly combined. All other spending earns 1% unlimited cashback, and the RuPay variant includes UPI transactions in the cashback program.

Flipkart’s card takes a tiered approach with impressive rates: 7.5% cashback on Myntra, 5% on Flipkart and Cleartrip, 4% on merchants like Swiggy and PVR, 1.5% on all other online spends, and 1% on offline transactions. The absence of monthly caps on these categories makes it exceptional for heavy online spenders. Both cards credit cashback directly to your statement in real-time, and rewards expire after 12 months.

| Earning Category | Airtel Axis Bank Card | Flipkart Axis Bank Card |

|---|---|---|

| Base Earning Rate | 1% unlimited (includes UPI on RuPay) | 1.5% online / 1% offline |

| Top Category | 25% on Airtel payments (cap ₹250/month) | 7.5% on Myntra (uncapped) |

| Secondary Category | 10% on utilities (cap ₹250/month) | 5% on Flipkart, Cleartrip (uncapped) |

| Preferred Merchants | 10% on Swiggy, Zomato, BigBasket (cap ₹500/month) | 4% on Swiggy, PVR, etc. (uncapped) |

| Spending Caps | Multiple category caps | No caps |

| Reward Expiry | 12 months | 12 months |

Redeeming Your Rewards: Airtel vs Flipkart Axis Bank Credit Card

Redemption is refreshingly simple on both cards. Cashback accumulates and gets credited directly to your statement, reducing your outstanding balance. The minimum redemption threshold is ₹300 cashback value for both cards—easily achievable with regular spending. You can also convert rewards to vouchers if you prefer. The Flipkart card offers the additional option of transferring cashback to your Flipkart wallet, giving you direct purchasing power on the platform. Processing takes up to 7 days for most redemption methods, and there are no redemption fees. Since cashback is auto-credited to statements, you don’t need to manually redeem unless you prefer vouchers or wallet credits. Just remember that unredeemed rewards expire after 12 months, so keep an eye on your accrued balance.

Airtel vs Flipkart Axis Bank Credit Card: Airport Lounge Benefits

Here’s where the cards diverge sharply. The Airtel Axis Bank Credit Card offers 1 complimentary domestic lounge visit per quarter—but there’s a catch: you need to spend ₹50,000 or more in the last 3 months to maintain eligibility for free access. This modest benefit adds travel value for users who can consistently meet the spending threshold. The Flipkart Axis Bank Credit Card does not offer any lounge access—a clear trade-off for its lifetime free status and superior e-commerce cashback rates. Neither card offers international lounge access. If lounge benefits matter to you and you regularly spend ₹50,000+ quarterly (₹2 lakh annually), the Airtel card delivers travel perks. Otherwise, consider the Flipkart card’s higher cashback rates and zero annual fee as better value.

| Lounge Benefit | Airtel Axis Bank Card | Flipkart Axis Bank Card |

|---|---|---|

| Domestic Visits | 1 per quarter | Not available |

| Spending Condition | ₹50,000+ in last 3 months | — |

| Lounge Network | Standard domestic lounges | — |

| International Access | Not available | Not available |

| Guest Policy | Paid, subject to rules | — |

When to Use Airtel vs Flipkart Axis Bank Credit Card

Use the Airtel card when: You’re an Airtel subscriber paying monthly mobile, DTH, or broadband bills (maximize that 25% cashback). You regularly pay utility bills like electricity, gas, or water (grab 10% cashback). You order food frequently on Swiggy or Zomato (10% cashback up to ₹500/month combined with BigBasket). You travel occasionally and can spend ₹50,000 quarterly for lounge access. You prefer using UPI on the RuPay variant to earn 1% cashback on digital payments. Your monthly spending is around ₹2-3 lakh, mostly on bills and everyday categories.

Use the Flipkart card when: You shop regularly on Flipkart or Myntra, especially during sales (5% and 7.5% cashback respectively). You order food on Swiggy or book movie tickets at PVR (4% cashback uncapped). You want a lifetime free card with no annual fee hassles. Your overall online spending is substantial and you want uncapped, high-rate cashback. You value 1.5% base rate on all other online purchases. You don’t need lounge access and prioritize cashback over travel perks.

Real-world example: If you spend ₹5,000 monthly on Airtel services and ₹3,000 on utilities, the Airtel card gives you ₹500 cashback (₹1,250 on Airtel capped at ₹250, plus ₹300 on utilities). The same ₹8,000 on the Flipkart card earns only ₹120 (₹80 online at 1.5% + ₹40 offline at 1%). But if you spend ₹20,000 on Flipkart monthly, you earn ₹1,000 cashback (5%)—far better than Airtel’s ₹200 (1% base rate). Similarly, ₹10,000 on Myntra gives ₹750 cashback on Flipkart card versus just ₹100 on Airtel card.

Common Questions About Airtel vs Flipkart Axis Bank Credit Card

Q1: Are these cards lifetime free?

The Flipkart card is lifetime free for select channels, making it an excellent no-fee option. The Airtel card charges ₹590 annually but waives fees if you spend ₹2 lakh per year.

Q2: Can I transfer reward points between these cards?

No, reward points or cashback cannot be transferred between cards or to other loyalty programs. Each card’s rewards are self-contained.

Q3: Which card is better for lounge access?

The Airtel card offers 1 lounge visit per quarter (with ₹50,000 spending in last 3 months), while the Flipkart card has no lounge benefits.

Q4: How do I maximize rewards on each card?

For Airtel: Pay all Airtel bills through the Airtel Thanks app, use it for utilities, maximize partner merchant categories (Swiggy, Zomato, BigBasket) up to monthly caps, and use the RuPay variant for UPI payments. For Flipkart: Consolidate online shopping on Flipkart (5%), Myntra (7.5%), use it for Swiggy and PVR (4%), and make it your primary card for all online purchases (1.5% base rate).

Q5: Can I upgrade to a premium Axis Bank card later?

Yes, both cards offer upgrade options based on your credit profile and relationship with Axis Bank. Contact customer service after 6-12 months of responsible card usage.

Q6: Does the Airtel card work with all UPI apps?

The RuPay variant of the Airtel card earns 1% cashback on UPI transactions, making it valuable for digital payment users across all UPI-enabled apps.

Which Card Should You Choose: Airtel or Flipkart Axis Bank Credit Card?

Both cards serve distinct audiences within the entry-level cashback segment. The Airtel Axis Bank Credit Card is purpose-built for Airtel ecosystem users and bill payers, delivering industry-leading 25% cashback on Airtel services and 10% on utilities—benefits that quickly offset the ₹590 annual fee if you’re a loyal customer. It adds 1 quarterly lounge visit for travelers who spend ₹50,000+ every three months, and the RuPay variant enables UPI cashback, making it versatile for digital payment enthusiasts. Its lower ₹2 lakh annual spending requirement for fee waiver and ₹15,000 monthly income eligibility make it accessible. However, cashback caps (₹250 on Airtel, ₹250 on utilities, ₹500 on partners) limit earning potential for high spenders.

The Flipkart Axis Bank Credit Card targets online shopping enthusiasts with 7.5% cashback on Myntra, 5% on Flipkart and Cleartrip, 4% on Swiggy and PVR, and uncapped rewards—no monthly limits mean heavy spenders truly benefit. The 1.5% base rate on all online transactions beats most entry-level cards, and being lifetime free for select channels eliminates annual fee concerns entirely. However, it demands higher income (₹20,000/month), offers no lounge access, and gives only 1% on offline spends, making it less attractive for non-digital transactions.

Choose the Airtel card if: You’re an Airtel subscriber spending ₹3,000+ monthly on Airtel services and utilities, prefer maximizing category-specific cashback, want occasional lounge access, use UPI frequently (RuPay variant), and can comfortably reach ₹2 lakh annual spending for fee waiver.

Choose the Flipkart card if: You’re a heavy online shopper on Flipkart/Myntra, want premium cashback rates (5-7.5%) without monthly caps, prefer a lifetime free card with no fee hassles, primarily shop online (1.5% vs 1% advantage), and don’t need lounge access or travel perks.

Final verdict: The Airtel card wins for bill-focused spenders with Airtel connections who value modest travel benefits; the Flipkart card wins for e-commerce enthusiasts seeking maximum online cashback without annual fees. Pick the one aligned with your natural spending pattern—the Flipkart card’s lifetime free status and uncapped high-rate cashback make it compelling for online shoppers, while the Airtel card’s ecosystem benefits and quarterly lounge access serve utility-focused users better.

Ready to apply? Visit Axis Bank’s Airtel card page or Flipkart card page to get started.

You might also be interested in:

Latest Blogs

Club Vistara IDFC FIRST vs HDFC Diners Club Black Credit Card Comparison

Club Vistara IDFC FIRST vs HDFC Diners Club Black Credit Card Comparison

IDFC FIRST WOW vs Tata Neu Plus SBI Card: Best Pick?

IDFC FIRST WOW vs Tata Neu Plus SBI Card: Best Pick?

HDFC Regalia Gold vs Tata Neu Plus: Which Card Wins?

HDFC Regalia Gold vs Tata Neu Plus: Which Card Wins?

ICICI Sapphiro vs Axis Reserve Credit Card: Which Premium Card Wins?

ICICI Sapphiro vs Axis Reserve Credit Card: Which Premium Card Wins?

IndiGo Kotak XL vs IndiGo Kotak Credit Card

IndiGo Kotak XL vs IndiGo Kotak Credit Card

Airtel Axis Bank Credit Card vs Flipkart Axis Bank Credit Card: Which Cashback Card is Best in 2025?

Airtel Axis Bank Credit Card vs Flipkart Axis Bank Credit Card: Which Cashback Card is Best in 2025?