SBI Card PULSE

The SBI Card PULSE is designed for health-conscious individuals and fitness enthusiasts, offering 10X reward points on pharmacy, chemist, dining, and movie spends, along with complimentary wellness memberships (FITPASS PRO and Netmeds First) and a free smartwatch worth ₹7,999, making it the perfect companion for those who prioritize health, lifestyle rewards, and travel benefits.

Apply Now ❯| Feature | Details |

|---|---|

| Bank / Issuer | SBI |

| Card Type | Visa |

| Joining Fee | 1499 Plus GST |

| Annual Fee | 1499 Plus GST |

| Welcome Benefits | Noise ColorFit Pulse Pro/2 Max Smartwatch (voucher sent within 45 days of joining fee payment), 1-year complimentary FITPASS PRO Membership (renewed annually on fee payment), 1-year complimentary Netmeds First Membership (renewed annually on fee payment) |

| Fee Waiver Condition | Annual fee of ₹1,499 is waived if you spend ₹2,00,000 or more in the card membership year. |

| Reward Rates | Earn 10 Reward Points per ₹100 (10% reward rate, equivalent to 2.5% value-back) on pharmacy, chemist, movies, and dining with a cap of 7,500 bonus points per month. Earn 2 Reward Points per ₹100 (2% reward rate, equivalent to 0.5% value-back) on all other eligible purchases. 4 Reward Points = ₹1 (1 Reward Point = ₹0.25). No points on wallet loads, fuel, and EMI transactions. |

| Interest Rates | 3.5% - 3.75% per month (42% - 45% per annum) |

| Foreign Exchange Markup | 3.5% markup on international transactions |

| Best For | Dinning |

| Lounge Access | Domestic: 2 per quarter |

Key Features & Benefits

The SBI Card PULSE stands out as India’s premier health and wellness credit card, delivering exceptional value through its comprehensive benefits package. Upon joining, cardholders receive a Noise ColorFit Pulse Pro/2 Max Smartwatch along with one-year complimentary memberships to FITPASS PRO and Netmeds First, both of which renew annually with card renewal. This makes it an ideal choice for fitness enthusiasts who regularly spend on health-related categories.

The card’s reward structure is particularly attractive for everyday wellness and entertainment spending. Earn an impressive 10 reward points per ₹100 spent on pharmacy, chemist, sports goods, dining, and movie tickets—equivalent to a 2.5% return when redeemed against card dues. All other eligible purchases earn 2 points per ₹100. With the flexibility to convert 4 reward points into ₹1 for statement credits or redeem across SBI’s extensive rewards catalogue, cardholders enjoy meaningful savings on routine expenses.

Travel benefits add another layer of value with 8 complimentary domestic airport lounge visits per year. The annual fee of ₹1,499 plus GST is easily waived with ₹2 lakh in annual spending, and high spenders who cross ₹4 lakh receive an additional ₹1,500 e-voucher. Combined with 1% fuel surcharge waiver and exclusive partner offers, the SBI Card PULSE delivers comprehensive lifestyle rewards for health-focused consumers.

All You Need to Know About: SBI Card PULSE

The SBI Card PULSE is a lifestyle-focused credit card issued by State Bank of India, available on Visa, RuPay, and Mastercard networks. Launched to cater to health-conscious consumers and fitness enthusiasts, this card combines wellness benefits with attractive rewards and travel perks. The card charges a joining fee and annual fee of ₹1,499 plus 18% GST each, though the annual fee is waived on spending ₹2 lakh or more in a card membership year. Upon joining, cardholders receive a Noise ColorFit Pulse Pro or 2 Max Smartwatch delivered via voucher within 45 days of joining fee payment. Additionally, members get complimentary one-year subscriptions to FITPASS PRO (for gym and fitness center access) and Netmeds First (for healthcare and medicine benefits), both of which are automatically renewed each year when the annual fee is paid.

The reward structure is designed to maximize value on health and lifestyle spending. Cardholders earn 10 reward points for every ₹100 spent on pharmacy, chemist, sports goods, dining, and movie tickets, with a monthly cap of 7,500 bonus points on these accelerated categories. All other eligible retail purchases earn 2 reward points per ₹100. These points hold significant value as 4 reward points equal ₹1 when redeemed against card outstanding dues, translating to an effective 2.5% return on accelerated spends and 0.5% on regular purchases. Points can also be redeemed across SBI’s extensive rewards catalogue for merchandise, vouchers, and experiences. Important exclusions include wallet loads, fuel transactions, and EMI conversions, which do not earn reward points. A ₹99 fee is charged per reward redemption request.

Travel benefits include 8 complimentary domestic airport lounge visits per year with a quarterly cap of 2 visits, accessible without any minimum spending requirement. However, international lounge access and Priority Pass membership benefits were discontinued after mid-2025, which limits the card’s appeal for international travelers. High spenders are rewarded with a milestone benefit of ₹1,500 e-voucher upon completing ₹4 lakh in annual retail spending. The card also offers 1% fuel surcharge waiver on transactions between ₹500 and ₹4,000, with a maximum waiver of ₹250 per statement cycle. Additional features include zero charges on add-on cards, making it family-friendly.

The SBI Card PULSE carries an interest rate of 3.5% to 3.75% per month (42% to 45% per annum) on revolving balances, which is on the higher side compared to many competitors. Foreign exchange transactions attract a 3.5% markup. Other charges include over-limit fees of 2.5% with a minimum of ₹600, cash advance fees of 2.5% with a minimum of ₹500, and standard late payment penalties. The card previously offered air accident insurance coverage of ₹50 lakh, but this benefit was discontinued from July 2025. Credit limits typically range from ₹50,000 to ₹5 lakh or higher based on individual credit profiles. The application process is entirely online through the official SBI Card website, with most applications processed within 24 to 72 hours. The card targets urban professionals, fitness enthusiasts, and health-conscious individuals who value integrated wellness benefits alongside traditional credit card rewards. With its unique combination of health memberships, smartwatch welcome gift, strong dining and pharmacy rewards, and domestic lounge access, the SBI Card PULSE positions itself as a comprehensive lifestyle card for those seeking value from everyday wellness and entertainment spending.

Pros & Cons

Pros

- High 10X reward points on pharmacy, chemist, dining, movies, and sports spends with attractive redemption value

- Complimentary Noise smartwatch, FITPASS PRO, and Netmeds First memberships (renewed annually)

- 8 domestic airport lounge visits per year with no spending threshold required

- Easily achievable annual fee waiver at ₹2 lakh spends

- Additional ₹1,500 milestone voucher on ₹4 lakh annual spending

Cons

- High interest rate of 3.5%-3.75% per month (42%-45% per annum)

- No international lounge access or Priority Pass benefits (discontinued post mid-2025)

- Reward points capped at 7,500 per month on accelerated categories

- ₹99 redemption fee charged per reward redemption request

- 3.5% foreign exchange markup on international transactions

How to Apply

Applying for the SBI Card PULSE is a straightforward online process. Visit the official SBI Card website at https://www.sbicard.com/en/personal/credit-cards/lifestyle/sbi-card-pulse.page and click on “Apply Now.” Fill in your personal, employment, and financial details in the online application form. Upload required documents including identity proof, address proof, and income documents (salary slips or ITR). Submit your application and await instant or within 24-72 hours approval, subject to credit assessment. Once approved, your card will be delivered to your registered address, and you can activate it to start enjoying the wellness and lifestyle benefits immediately.

Detailed Fee Structure

The SBI Card PULSE has a joining fee of ₹1,499 plus 18% GST (total ₹1,768.82), which is charged upfront upon card issuance. The annual renewal fee is also ₹1,499 plus GST, billed from the second year onwards. However, this annual fee is completely waived if you spend ₹2,00,000 or more during the card membership year, making it effectively free for moderate to high spenders.

Beyond the basic fees, there are several ancillary charges to be aware of. Add-on cards are issued free of cost. A reward redemption fee of ₹99 is charged per redemption request. If you exceed your credit limit, an over-limit fee of 2.5% of the over-limit amount (minimum ₹600) applies. Cash advance transactions attract a 2.5% fee with a minimum of ₹500. Late payment charges range based on the outstanding amount. The card carries a high interest rate of 3.5%-3.75% per month (42%-45% per annum) on revolving credit, and international transactions incur a 3.5% foreign exchange markup. Understanding these charges helps cardholders avoid unexpected costs and maximize value from their SBI Card PULSE.

Who Should Get This Card?

The SBI Card PULSE is ideal for health-conscious professionals, fitness enthusiasts, and wellness-focused individuals who regularly spend on pharmacy, medical supplies, gym memberships, healthy dining, and entertainment. It’s particularly suited for urban millennials and Gen Z consumers who value integrated health benefits like FITPASS PRO and Netmeds memberships alongside traditional credit card rewards. Frequent domestic travelers who can utilize the 8 complimentary airport lounge visits will find added value. The card is best for those who can comfortably spend ₹2 lakh annually to waive the renewal fee and maximize the 10X rewards on accelerated categories. If you’re someone who prioritizes lifestyle rewards, fitness tracking through the complimentary smartwatch, and prefers a credit card that aligns with a healthy, active lifestyle, the SBI Card PULSE is an excellent choice.

Alternatives & Competitor Comparison

| Feature | SBI Card PULSE | HDFC Regalia Gold Credit Card |

|---|---|---|

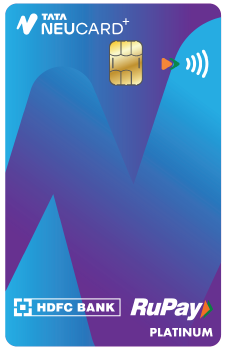

| Card Image |  |  |

| Card Network | Visa | Mastercard |

| USP | The SBI Card PULSE is designed for health-conscious individuals and fitness enthusiasts, offering 10X reward points on pharmacy, chemist, dining, and movie spends, along with complimentary wellness memberships (FITPASS PRO and Netmeds First) and a free smartwatch worth ₹7,999, making it the perfect companion for those who prioritize health, lifestyle rewards, and travel benefits. | The HDFC Regalia Gold Credit Card delivers 5X accelerated rewards on premium brands like Myntra, Nykaa, and Reliance Digital, plus milestone vouchers worth up to ₹10,000 annually and extensive lounge access with 12 domestic and 6 international visits per year, making it perfect for lifestyle enthusiasts and frequent travelers seeking premium benefits at a competitive annual fee. |

| Annual Fee | 1499 Plus GST | 2500 Plus GST |

| Joining Fee | 1499 Plus GST | 2500 Plus GST |

| Welcome Benefits | Noise ColorFit Pulse Pro/2 Max Smartwatch (voucher sent within 45 days of joining fee payment), 1-year complimentary FITPASS PRO Membership (renewed annually on fee payment), 1-year complimentary Netmeds First Membership (renewed annually on fee payment) | ₹2,500 voucher on joining fee payment, complimentary Swiggy One membership, complimentary MakeMyTrip Black Elite membership, Club Vistara Silver membership on spending ₹1 lakh in first 90 days |

| Lounge Access | Domestic: 2 per quarter | Domestic: 12 per year | International: 6 per year |

| Reward Rate | Earn 10 reward points per ₹100 (10% reward rate, equivalent to 2.5% value-back) on pharmacy, chemist, movies, and dining with a cap of 7,500 bonus points per month. Earn 2 reward points per ₹100 (2% reward rate, equivalent to 0.5% value-back) on all other eligible purchases. 4 reward points = ₹1 (1 reward Point = ₹0.25). No points on wallet loads, fuel, and EMI transactions. | 4 reward points per ₹150 spent (2.67% return) on retail, insurance, utility, and education. Earn 20 reward points per ₹150 spent (13.33% return) at Marks & Spencer, Myntra, Nykaa, and Reliance Digital (5X accelerated rewards with capping). milestone benefits: ₹1,500 vouchers on ₹1.5 lakh quarterly spend, ₹5,000 flight vouchers on ₹5 lakh annual spend, additional ₹5,000 flight vouchers on ₹7.5 lakh annual spend. |

| Interest Rate | 3.5% - 3.75% per month (42% - 45% per annum) | 3.75% per month (45% per annum) |

| Best For | Dinning | Lounge Access, Online Shopping |

| Apply Now | Apply Now | Apply Now |

Frequently Asked Questions

What is the annual fee for the SBI Card PULSE and how can it be waived?

The SBI Card PULSE has an annual fee of ₹1,499 plus 18% GST (₹1,768.82 total). This annual renewal fee is completely waived if you spend ₹2,00,000 or more on retail transactions within the card membership year, making it cost-effective for regular users.

What reward points do I earn with the SBI Card PULSE on different spending categories?

The SBI Card PULSE offers 10 reward points per ₹100 spent on pharmacy, chemist, sports goods, dining, and movie purchases (capped at 7,500 points per month). On all other eligible transactions, you earn 2 reward points per ₹100. Each 4 reward points can be redeemed for ₹1 against your card outstanding.

What welcome benefits do I get with the SBI Card PULSE?

Upon paying the joining fee for the SBI Card PULSE, you receive a Noise ColorFit Pulse Pro/2 Max Smartwatch (voucher sent within 45 days), along with complimentary one-year memberships to FITPASS PRO and Netmeds First. Both memberships are renewed annually when you pay the card's annual fee.

How many airport lounge visits does the SBI Card PULSE provide?

The SBI Card PULSE provides 8 complimentary domestic airport lounge visits per year, with a maximum of 2 visits allowed per quarter. There is no spending threshold required to access these lounges. Note that international lounge access and Priority Pass benefits have been discontinued post mid-2025.

What is the interest rate and foreign exchange markup on the SBI Card PULSE?

The SBI Card PULSE charges an interest rate of 3.5% to 3.75% per month (42% to 45% per annum) on revolving credit balances. For international transactions, a foreign exchange markup of 3.5% is applied on top of the transaction amount.

Final Verdict

Is the SBI Card PULSE right for you? If you're a health-conscious individual who regularly spends on pharmacy, fitness, dining, and entertainment, this card delivers exceptional value with its 10X rewards, complimentary wellness memberships, and free smartwatch. The annual fee waiver at ₹2 lakh spending is achievable for most working professionals, and the 8 domestic lounge visits add travel convenience. While the high interest rate and lack of international lounge access are drawbacks, the comprehensive health and lifestyle benefits make it a standout choice in its category. The SBI Card PULSE is particularly rewarding for those who prioritize wellness spending and want a credit card that supports their active lifestyle. If this matches your profile, apply now to unlock superior rewards, exclusive fitness partnerships, and meaningful savings on everyday health expenses.

You might also be interested in:

Latest Blogs

Club Vistara IDFC FIRST vs HDFC Diners Club Black Credit Card Comparison

Club Vistara IDFC FIRST vs HDFC Diners Club Black Credit Card Comparison

IDFC FIRST WOW vs Tata Neu Plus SBI Card: Best Pick?

IDFC FIRST WOW vs Tata Neu Plus SBI Card: Best Pick?

HDFC Regalia Gold vs Tata Neu Plus: Which Card Wins?

HDFC Regalia Gold vs Tata Neu Plus: Which Card Wins?

ICICI Sapphiro vs Axis Reserve Credit Card: Which Premium Card Wins?

ICICI Sapphiro vs Axis Reserve Credit Card: Which Premium Card Wins?

IndiGo Kotak XL vs IndiGo Kotak Credit Card

IndiGo Kotak XL vs IndiGo Kotak Credit Card

Airtel Axis Bank Credit Card vs Flipkart Axis Bank Credit Card: Which Cashback Card is Best in 2025?

Airtel Axis Bank Credit Card vs Flipkart Axis Bank Credit Card: Which Cashback Card is Best in 2025?

Latest Comparisons

Flipkart SBI vs Axis Bank Credit Card – Best for Online Shopping Rewards?

Flipkart SBI vs Axis Bank Credit Card – Best for Online Shopping Rewards?

IDFC FIRST Select vs Federal Bank Scapia vs IndusInd Tiger – Best Lifetime Free Card?

IDFC FIRST Select vs Federal Bank Scapia vs IndusInd Tiger – Best Lifetime Free Card?

HDFC Regalia Gold vs ICICI Sapphiro vs SBI ELITE – Best Premium Card?

HDFC Regalia Gold vs ICICI Sapphiro vs SBI ELITE – Best Premium Card?

SBI SimplySAVE vs SimplyCLICK Credit Card – Best for Rewards?

SBI SimplySAVE vs SimplyCLICK Credit Card – Best for Rewards?

HDFC Millenia vs Tata Neu Plus vs Swiggy Credit Card – Best for Rewards?

HDFC Millenia vs Tata Neu Plus vs Swiggy Credit Card – Best for Rewards?

ICICI Sapphiro vs IDFC Mayura vs HDFC Diners Black – Best Premium Travel Card?

ICICI Sapphiro vs IDFC Mayura vs HDFC Diners Black – Best Premium Travel Card?