ICICI Bank Sapphiro Credit Card

The ICICI Bank Sapphiro Credit Card offers premium rewards with 1% value on international spends and 0.5% on domestic purchases (at ₹0.25 per reward point), plus exclusive golf privileges, lounge access, and lifestyle benefits worth ₹9,000, making it perfect for affluent travelers and premium lifestyle enthusiasts.

Apply Now ❯| Feature | Details |

|---|---|

| Bank / Issuer | ICICI Bank |

| Card Type | Amex, Mastercard, RuPay, Visa |

| Joining Fee | 6500 Plus GST |

| Annual Fee | 3500 Plus GST |

| Welcome Benefits | Vouchers worth approximately ₹9,000 from partners like Uber, EaseMyTrip, Tata CLiQ, and Tata Croma |

| Fee Waiver Condition | Annual fee of ₹3,500 is waived if you spend ₹6,00,000 or more in the card membership year. |

| Reward Rates | Earn 4 reward points per ₹100 (1% value at ₹0.25 per point) on international spends, 2 reward points per ₹100 (0.5% value) on domestic spends except fuel, and 1 reward point per ₹100 (0.25% value) on fuel, utilities, and insurance spends. |

| Eligibility Criteria (Salary) | 900000 |

| Eligibility Criteria (Self-Employed) | 900000 |

| Interest Rates | 3.75% per month (approximately 45% per annum) |

| Foreign Exchange Markup | 3.5% on international transactions |

| Best For | Lounge Access |

| Lounge Access |

Domestic: 4 per quarter | International: 2 per year On spends of ₹75,000+ in the last 3 months |

Key Features & Benefits

The ICICI Bank Sapphiro Credit Card delivers exceptional value for high-spending individuals through its comprehensive reward structure and premium lifestyle benefits. Cardholders earn accelerated rewards with 4 points per ₹100 (1% value at ₹0.25 per point) on international transactions and 2 points per ₹100 (0.5% value) on domestic spends, while milestone bonuses provide additional 4,000 points (₹1,000 value) on ₹4 lakh annual spending and 2,000 points (₹500 value) for every additional ₹1 lakh spent thereafter.

Beyond rewards, the card excels in travel and lifestyle perks with 16 complimentary domestic lounge visits annually and 2 international lounge access, plus 48 free golf rounds per year upon crossing ₹6 lakh spending threshold. Welcome benefits include vouchers worth ₹9,000 from premium partners like Uber and Tata CLiQ, while comprehensive insurance coverage provides ₹3 crore personal accident protection, purchase protection, and travel insurance for complete peace of mind.

All You Need to Know About: ICICI Bank Sapphiro Credit Card

The ICICI Bank Sapphiro Credit Card stands as a premium offering designed for affluent individuals seeking comprehensive lifestyle benefits and accelerated rewards. Available across multiple networks including Visa, Mastercard, RuPay, and American Express, this card caters to diverse preferences while maintaining consistent premium features. With a joining fee of ₹6,500 plus GST and annual fee of ₹3,500 plus GST, the card positions itself in the premium segment, though the annual fee becomes waivable upon crossing ₹6 lakh annual spending threshold.

The reward structure emphasizes international and domestic spending with 4 reward points per ₹100 (1% value at ₹0.25 per point) on international transactions, 2 points per ₹100 (0.5% value) on domestic purchases, and 1 point per ₹100 (0.25% value) on fuel, utilities, and insurance payments. Milestone benefits enhance earning potential with 4,000 bonus points (₹1,000 value) on ₹4 lakh annual spending and additional 2,000 points (₹500 value) for every ₹1 lakh spent thereafter, capped at 20,000 points annually. These reward points can be redeemed across various categories including travel, shopping vouchers, electronics, fashion, and dining at ₹0.25 per point value.

Travel and lifestyle benefits form the card’s core strength with 16 complimentary domestic lounge visits annually (4 per quarter on ₹75,000 quarterly spend) and 2 international lounge visits. Golf enthusiasts receive 48 complimentary golf rounds per year upon crossing ₹6 lakh annual spending, while additional perks include BookMyShow offers, dining discounts, and concierge services. Comprehensive insurance coverage provides ₹3 crore personal accident protection, ₹1.4 lakh purchase protection, baggage loss coverage, and travel inconvenience insurance. Welcome benefits worth approximately ₹9,000 from premium partners like Uber, EaseMyTrip, Tata CLiQ, and Tata Croma provide immediate value upon card approval.

Eligibility requires minimum income of ₹9 lakh annually for both salaried and self-employed individuals, with business owner requirements typically aligning with self-employed thresholds. The card charges 3.75% monthly interest (approximately 45% annually) on outstanding balances and 3.5% foreign exchange markup on international transactions. Processing typically takes 7-10 days after approval, with PIN delivered separately for enhanced security, making this card ideal for premium lifestyle seekers who can maximize its extensive benefit portfolio.

Pros & Cons

Pros

- High reward rates delivering 1% value on international and 0.5% on domestic spends

- Generous lounge access and golf privileges for lifestyle enthusiasts

- Substantial welcome benefits worth ₹9,000 from premium partners

- Comprehensive insurance coverage including ₹3 crore accident protection

- Annual fee waiver available on ₹6 lakh spending

Cons

- High joining fee of ₹6,500 plus GST may deter cost-conscious users

- Premium income requirements limit accessibility to high earners only

- Foreign exchange markup of 3.5% relatively high for international travelers

- Lower reward rate (1%) on fuel and utility payments

How to Apply

Visit the ICICI Bank official website or mobile app and navigate to the credit card section. Select the Sapphiro Credit Card and click “Apply Now” to fill the online application form with personal, professional, and financial details. Submit required KYC documents including income proof, identity verification, and address proof digitally. After verification and approval, the card will be delivered within 7-10 days with PIN sent separately for security.

Detailed Fee Structure

The ICICI Bank Sapphiro Credit Card charges a joining fee of ₹6,500 plus applicable GST and an annual renewal fee of ₹3,500 plus GST, though the annual fee is waived on spending ₹6 lakh or more in the previous membership year. Additional charges include late payment fees, cash advance charges of approximately 2.5% with a minimum of ₹300, over-limit fees, and foreign exchange markup of 3.5% on international transactions. Interest rates apply at 3.75% per month (approximately 45% per annum) on outstanding balances, making timely payments crucial to avoid high finance charges.

Who Should Get This Card?

This premium credit card is ideal for high-income individuals earning above ₹9 lakh annually who frequently travel internationally, enjoy golf, and seek comprehensive lifestyle benefits. Perfect for affluent professionals, business owners, and premium lifestyle enthusiasts who can leverage the high spending thresholds for fee waivers and bonus rewards. The card suits those who prioritize lounge access, concierge services, and comprehensive insurance coverage over basic cashback offers.

Alternatives & Competitor Comparison

| Feature | ICICI Bank Sapphiro Credit Card | Axis Atlas Credit Card |

|---|---|---|

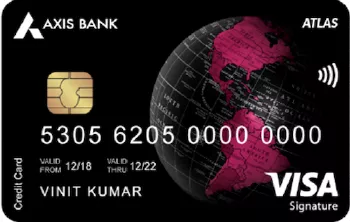

| Card Image |  |  |

| Card Network | Amex, Mastercard, RuPay, Visa | Mastercard, Visa |

| USP | The ICICI Bank Sapphiro Credit Card offers premium rewards with 1% value on international spends and 0.5% on domestic purchases (at ₹0.25 per reward point), plus exclusive golf privileges, lounge access, and lifestyle benefits worth ₹9,000, making it perfect for affluent travelers and premium lifestyle enthusiasts. | The Axis Atlas Credit Card is a premium travel rewards card designed for frequent flyers and luxury travelers, offering high EDGE miles on airline and hotel bookings, exclusive lounge access, and milestone bonuses for big spenders. Enjoy seamless travel perks, rewarding redemptions, and global acceptance. |

| Annual Fee | 3500 Plus GST | 5000 Plus GST |

| Joining Fee | 6500 Plus GST | 5000 Plus GST |

| Welcome Benefits | Vouchers worth approximately ₹9,000 from partners like Uber, EaseMyTrip, Tata CLiQ, and Tata Croma | 2,500 EDGE miles credited on spending minimum 3 transactions within 37 days of card issuance, which can be redeemed for travel stays and flights worth roughly ₹5,000. |

| Lounge Access | Domestic: 4 per quarter | International: 2 per year On spends of ₹75,000+ in the last 3 months | Domestic: 2 per quarter | International: 1 per quarter |

| Reward Rate | Earn 4 reward points per ₹100 (1% value at ₹0.25 per point) on international spends, 2 reward points per ₹100 (0.5% value) on domestic spends except fuel, and 1 reward point per ₹100 (0.25% value) on fuel, utilities, and insurance spends. | 5 EDGE miles per ₹100 on travel bookings via Axis Bank Travel Edge up to ₹2 lakh monthly and 2 EDGE miles per ₹100 on all other spends. |

| Interest Rate | 3.75% per month (approximately 45% per annum) | 3.49% per month (around 42% per annum) |

| Best For | Lounge Access | Lounge Access, Travel |

| Apply Now | Apply Now | Apply Now |

Frequently Asked Questions

What is the minimum income required for ICICI Bank Sapphiro Credit Card?

The minimum income requirement for ICICI Bank Sapphiro Credit Card is ₹75,000 per month for salaried individuals and ₹9 lakh annually for self-employed applicants.

How can I waive the annual fee on ICICI Bank Sapphiro Credit Card?

The annual fee of ₹3,500 for ICICI Bank Sapphiro Credit Card is automatically waived when you spend ₹6 lakh or more in the previous membership year.

What are the reward rates on ICICI Bank Sapphiro Credit Card?

ICICI Bank Sapphiro Credit Card offers 4 reward points per ₹100 (1% value at ₹0.25 per point) on international spends, 2 points per ₹100 (0.5% value) on domestic purchases, and 1 point per ₹100 (0.25% value) on fuel and utilities.

How many lounge visits does ICICI Bank Sapphiro Credit Card provide?

ICICI Bank Sapphiro Credit Card provides up to 16 domestic lounge visits per year (4 per quarter on ₹75,000 quarterly spend) and 2 complimentary international lounge visits annually.

What welcome benefits come with ICICI Bank Sapphiro Credit Card?

ICICI Bank Sapphiro Credit Card offers welcome benefits worth approximately ₹9,000 including vouchers from Uber, EaseMyTrip, Tata CLiQ, and Tata Croma upon card approval.

Final Verdict

Is the ICICI Bank Sapphiro Credit Card right for you? If you're a high-income individual who values premium lifestyle benefits, international travel rewards, and comprehensive insurance coverage, this card delivers exceptional value despite its premium pricing. The generous reward rates, extensive lounge access, golf privileges, and substantial welcome benefits justify the costs for affluent users who can meet spending thresholds. However, budget-conscious users or those with lower spending patterns might find better value in entry-level cards. Apply today if you seek a premium all-rounder credit card that elevates your lifestyle while rewarding your spending.

You might also be interested in:

Latest Blogs

Club Vistara IDFC FIRST vs HDFC Diners Club Black Credit Card Comparison

Club Vistara IDFC FIRST vs HDFC Diners Club Black Credit Card Comparison

IDFC FIRST WOW vs Tata Neu Plus SBI Card: Best Pick?

IDFC FIRST WOW vs Tata Neu Plus SBI Card: Best Pick?

HDFC Regalia Gold vs Tata Neu Plus: Which Card Wins?

HDFC Regalia Gold vs Tata Neu Plus: Which Card Wins?

ICICI Sapphiro vs Axis Reserve Credit Card: Which Premium Card Wins?

ICICI Sapphiro vs Axis Reserve Credit Card: Which Premium Card Wins?

IndiGo Kotak XL vs IndiGo Kotak Credit Card

IndiGo Kotak XL vs IndiGo Kotak Credit Card

Airtel Axis Bank Credit Card vs Flipkart Axis Bank Credit Card: Which Cashback Card is Best in 2025?

Airtel Axis Bank Credit Card vs Flipkart Axis Bank Credit Card: Which Cashback Card is Best in 2025?

Latest Comparisons

Flipkart SBI vs Axis Bank Credit Card – Best for Online Shopping Rewards?

Flipkart SBI vs Axis Bank Credit Card – Best for Online Shopping Rewards?

IDFC FIRST Select vs Federal Bank Scapia vs IndusInd Tiger – Best Lifetime Free Card?

IDFC FIRST Select vs Federal Bank Scapia vs IndusInd Tiger – Best Lifetime Free Card?

HDFC Regalia Gold vs ICICI Sapphiro vs SBI ELITE – Best Premium Card?

HDFC Regalia Gold vs ICICI Sapphiro vs SBI ELITE – Best Premium Card?

SBI SimplySAVE vs SimplyCLICK Credit Card – Best for Rewards?

SBI SimplySAVE vs SimplyCLICK Credit Card – Best for Rewards?

HDFC Millenia vs Tata Neu Plus vs Swiggy Credit Card – Best for Rewards?

HDFC Millenia vs Tata Neu Plus vs Swiggy Credit Card – Best for Rewards?

ICICI Sapphiro vs IDFC Mayura vs HDFC Diners Black – Best Premium Travel Card?

ICICI Sapphiro vs IDFC Mayura vs HDFC Diners Black – Best Premium Travel Card?