Club Vistara IDFC FIRST Credit Card

The Club Vistara IDFC FIRST Credit Card offers premium travel rewards with up to 3% Maharaja Points on regular spends, complimentary flight vouchers, airport lounge access, and exclusive Maharaja Club Silver membership, making it perfect for frequent Vistara flyers and premium lifestyle enthusiasts seeking accelerated travel benefits.

Apply Now ❯| Feature | Details |

|---|---|

| Bank / Issuer | IDFC First Bank |

| Card Type | Mastercard |

| Joining Fee | 4999 Plus GST |

| Annual Fee | 4999 Plus GST |

| Welcome Benefits | 1 Premium Economy ticket voucher, 1 class upgrade voucher, complimentary Maharaja Club Silver membership, 3-month EazyDiner Prime/BQ Prime subscription |

| Reward Rates | Earn 3% Maharaja Points on spends up to ₹1 lakh per cycle, 2% above ₹1 lakh, 5% on birthday dining, 0.5% on fuel/utilities/rent. Bonus 2,000 points for spending ₹30,000 in 2nd, 3rd, 4th billing cycles (first year only). |

| Eligibility Criteria (Salary) | 1200000 |

| Interest Rates | 0.75%-3.5% per month (9%-42% per annum) |

| Foreign Exchange Markup | 2.99% on international transactions |

| Best For | Lounge Access, Travel |

| Lounge Access |

Domestic: 2 per quarter | International: 1 per quarter On spends of ₹20,000+ in the last month |

Key Features & Benefits

The Club Vistara IDFC FIRST Credit Card transforms your spending into valuable travel rewards through the Maharaja Points system. Cardholders earn 3% Maharaja Points on all spends up to ₹1 lakh per billing cycle, with additional bonuses like 5% on birthday dining and exclusive early-spend bonuses of 2,000 points monthly for first-year users. The card’s premium welcome package includes a Premium Economy ticket voucher, class upgrade voucher, and complimentary Maharaja Club Silver membership, delivering immediate value worth thousands.

Beyond rewards, the card provides comprehensive travel benefits including domestic and international airport lounge access, trip cancellation insurance up to ₹10,000, and milestone-based ticket vouchers at ₹1.5L, ₹3L, ₹4.5L, ₹9L, and ₹12L annual spending thresholds. Premium lifestyle perks include 3-month EazyDiner Prime and BQ Prime subscriptions, ensuring dining and entertainment benefits complement your travel rewards. The Mastercard network provides global acceptance and security features for seamless international usage.

All You Need to Know About: Club Vistara IDFC FIRST Credit Card

The Club Vistara IDFC FIRST Credit Card is a premium travel-focused credit card issued by IDFC FIRST Bank Ltd. on the Mastercard network, designed specifically for Vistara and Air India frequent flyers. The card carries a joining fee of ₹4,999 plus GST (approximately ₹5,900 total) with an identical annual renewal fee structure, offering no fee waiver conditions or lifetime free variants. Eligibility requires a minimum annual income of ₹12 lakh for salaried individuals, while business and self-employed criteria depend on credit profile assessment. The card charges interest rates ranging from 0.75% to 3.5% per month (9% to 42% per annum) on outstanding balances, with a foreign exchange markup of 2.99% on international transactions.

The rewards program centers around Maharaja Points, offering 6 points per ₹200 spent (3% rate) on regular purchases up to ₹1 lakh per billing cycle, dropping to 4 points per ₹200 (2% rate) beyond this threshold. Special categories include 10 points per ₹200 (5% rate) on birthday dining spends, while fuel, utilities, rent, wallet reloads, and insurance transactions earn only 1 point per ₹200 (0.5% rate). New cardholders benefit from an early-spend bonus program, earning 2,000 additional Maharaja Points monthly for spending ₹30,000 in the 2nd, 3rd, and 4th billing cycles during the first year, totaling up to 6,000 bonus points.

Premium welcome benefits include a Premium Economy ticket voucher, class upgrade voucher, complimentary Maharaja Club Silver membership, and 3-month subscriptions to EazyDiner Prime and BQ Prime. The card provides comprehensive airport lounge access with 2 domestic visits per quarter (8 annually) and 1 international visit per quarter (4 annually), requiring monthly spending of ₹20,000 to maintain access privileges. Milestone rewards offer ticket vouchers at various annual spending thresholds: ₹1.5 lakh, ₹3 lakh, ₹4.5 lakh, ₹9 lakh, and ₹12 lakh, with a maximum of 5 vouchers per year.

Additional features include trip cancellation insurance covering up to ₹10,000 for flights and hotels with 2 claims annually, basic travel coverage, and partnership benefits with dining and entertainment platforms. The card excludes earning on EMI transactions, cash withdrawals, and balance transfers, while hidden charges include late payment fees of 15% of outstanding dues and ₹100 for card replacement. Processing typically takes 7-15 days for eligible applicants, with applications accepted through the official IDFC FIRST Bank website. The card targets premium spenders, frequent travelers, and those seeking comprehensive travel benefits despite the absence of fee waivers, making it suitable for high-income individuals prioritizing travel rewards over cost optimization.

Pros & Cons

Pros

- High 3% Maharaja Points earning rate on regular spends up to ₹1 lakh

- Premium welcome benefits including flight vouchers and Silver membership

- Comprehensive lounge access (domestic + international) with reasonable spending threshold

- Multiple milestone ticket vouchers for heavy spenders

- Early-spend bonus rewards for new cardholders

Cons

- No annual fee waiver available despite ₹5,900 total cost

- Reduced reward rate (2%) after ₹1 lakh monthly spending

- Limited to domestic lounge access without international spending requirement

- High income eligibility of ₹12 lakh annually

- Restricted earning on fuel, utilities, and wallet transactions

How to Apply

Visit the official IDFC FIRST Bank website and navigate to the credit cards section to access the Club Vistara card application. Complete the online application form with personal, financial, and employment details, ensuring you meet the ₹12 lakh annual income requirement. Upload required documents including income proof, identity verification, and address proof for processing. Submit your application and await approval, which typically takes 7-15 days for eligible profiles with good credit scores.

Detailed Fee Structure

The Club Vistara IDFC FIRST Credit Card carries a joining fee of ₹4,999 plus applicable GST, totaling approximately ₹5,900, with an identical annual renewal fee structure. The card does not offer any fee waiver conditions or lifetime free variants, making it a premium paid product. Additional charges include foreign exchange markup of 2.99% on international transactions, late payment fees of 15% of the outstanding due amount, and card replacement charges of ₹100. Interest rates range from 0.75% to 3.5% per month (9% to 42% per annum) on outstanding balances, making timely payments crucial for cost management.

Who Should Get This Card?

The Club Vistara IDFC FIRST Credit Card is ideal for frequent Vistara and Air India flyers who can maximize Maharaja Points for flight bookings and upgrades. High-income professionals earning ₹12+ lakh annually who spend significantly on dining, shopping, and travel will benefit from the premium reward rates and milestone vouchers. Premium lifestyle enthusiasts seeking airport lounge access, dining subscriptions, and exclusive travel perks will find substantial value. The card suits those comfortable with annual fees in exchange for comprehensive travel benefits and accelerated rewards earning potential.

Alternatives & Competitor Comparison

| Feature | Club Vistara IDFC FIRST Credit Card | Axis Atlas Credit Card |

|---|---|---|

| Card Image |  |  |

| Card Network | Mastercard | Mastercard, Visa |

| USP | The Club Vistara IDFC FIRST Credit Card offers premium travel rewards with up to 3% Maharaja points on regular spends, complimentary flight vouchers, airport lounge access, and exclusive Maharaja Club Silver membership, making it perfect for frequent Vistara flyers and premium lifestyle enthusiasts seeking accelerated travel benefits. | The Axis Atlas Credit Card is a premium travel rewards card designed for frequent flyers and luxury travelers, offering high EDGE miles on airline and hotel bookings, exclusive lounge access, and milestone bonuses for big spenders. Enjoy seamless travel perks, rewarding redemptions, and global acceptance. |

| Annual Fee | 4999 Plus GST | 5000 Plus GST |

| Joining Fee | 4999 Plus GST | 5000 Plus GST |

| Welcome Benefits | 1 Premium Economy ticket voucher, 1 class upgrade voucher, complimentary Maharaja Club Silver membership, 3-month EazyDiner Prime/BQ Prime subscription | 2,500 EDGE miles credited on spending minimum 3 transactions within 37 days of card issuance, which can be redeemed for travel stays and flights worth roughly ₹5,000. |

| Lounge Access | Domestic: 2 per quarter | International: 1 per quarter On spends of ₹20,000+ in the last month | Domestic: 2 per quarter | International: 1 per quarter |

| Reward Rate | Earn 3% Maharaja points on spends up to ₹1 lakh per cycle, 2% above ₹1 lakh, 5% on birthday dining, 0.5% on fuel/utilities/rent. bonus 2,000 points for spending ₹30,000 in 2nd, 3rd, 4th billing cycles (first year only). | 5 EDGE miles per ₹100 on travel bookings via Axis Bank Travel Edge up to ₹2 lakh monthly and 2 EDGE miles per ₹100 on all other spends. |

| Interest Rate | 0.75%-3.5% per month (9%-42% per annum) | 3.49% per month (around 42% per annum) |

| Best For | Lounge Access, Travel | Lounge Access, Travel |

| Apply Now | Apply Now | Apply Now |

Frequently Asked Questions

What is the Club Vistara IDFC FIRST Credit Card annual fee waiver condition?

The Club Vistara IDFC FIRST Credit Card does not offer any annual fee waiver condition. The card charges ₹4,999 plus GST (approximately ₹5,900) annually without spending-based waivers.

How many Maharaja Points does the Club Vistara IDFC FIRST Credit Card offer per rupee?

The Club Vistara IDFC FIRST Credit Card offers 6 Maharaja Points per ₹200 spent (3% rate) up to ₹1 lakh per cycle, and 4 points per ₹200 (2% rate) above ₹1 lakh monthly spending.

What welcome benefits does the Club Vistara IDFC FIRST Credit Card provide?

The Club Vistara IDFC FIRST Credit Card welcome benefits include 1 Premium Economy ticket voucher, 1 class upgrade voucher, complimentary Maharaja Club Silver membership, and 3-month EazyDiner Prime/BQ Prime subscriptions.

What is the lounge access benefit with Club Vistara IDFC FIRST Credit Card?

The Club Vistara IDFC FIRST Credit Card provides 2 domestic lounge visits per quarter (8 annually) and 1 international lounge visit per quarter (4 annually) on monthly spending of ₹20,000.

What is the minimum income requirement for Club Vistara IDFC FIRST Credit Card eligibility?

The Club Vistara IDFC FIRST Credit Card requires a minimum annual income of ₹12 lakh for salaried individuals, with business and self-employed criteria not explicitly specified but requiring good credit profiles.

Final Verdict

Is the Club Vistara IDFC FIRST Credit Card right for you? If you're a frequent Vistara flyer with high annual spending and comfortable paying premium fees for exclusive travel benefits, this card delivers exceptional value through accelerated Maharaja Points, flight vouchers, and comprehensive lounge access. However, occasional travelers or fee-sensitive users might find better alternatives with waiver conditions. The card's strength lies in its premium travel ecosystem and milestone rewards, making it worthwhile for dedicated Vistara customers seeking to maximize their flying experience. Apply now to unlock premium travel rewards and elevate your journey.

You might also be interested in:

Latest Blogs

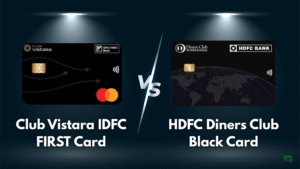

Club Vistara IDFC FIRST vs HDFC Diners Club Black Credit Card Comparison

Club Vistara IDFC FIRST vs HDFC Diners Club Black Credit Card Comparison

IDFC FIRST WOW vs Tata Neu Plus SBI Card: Best Pick?

IDFC FIRST WOW vs Tata Neu Plus SBI Card: Best Pick?

HDFC Regalia Gold vs Tata Neu Plus: Which Card Wins?

HDFC Regalia Gold vs Tata Neu Plus: Which Card Wins?

ICICI Sapphiro vs Axis Reserve Credit Card: Which Premium Card Wins?

ICICI Sapphiro vs Axis Reserve Credit Card: Which Premium Card Wins?

IndiGo Kotak XL vs IndiGo Kotak Credit Card

IndiGo Kotak XL vs IndiGo Kotak Credit Card

Airtel Axis Bank Credit Card vs Flipkart Axis Bank Credit Card: Which Cashback Card is Best in 2025?

Airtel Axis Bank Credit Card vs Flipkart Axis Bank Credit Card: Which Cashback Card is Best in 2025?

Latest Comparisons

Flipkart SBI vs Axis Bank Credit Card – Best for Online Shopping Rewards?

Flipkart SBI vs Axis Bank Credit Card – Best for Online Shopping Rewards?

IDFC FIRST Select vs Federal Bank Scapia vs IndusInd Tiger – Best Lifetime Free Card?

IDFC FIRST Select vs Federal Bank Scapia vs IndusInd Tiger – Best Lifetime Free Card?

HDFC Regalia Gold vs ICICI Sapphiro vs SBI ELITE – Best Premium Card?

HDFC Regalia Gold vs ICICI Sapphiro vs SBI ELITE – Best Premium Card?

SBI SimplySAVE vs SimplyCLICK Credit Card – Best for Rewards?

SBI SimplySAVE vs SimplyCLICK Credit Card – Best for Rewards?

HDFC Millenia vs Tata Neu Plus vs Swiggy Credit Card – Best for Rewards?

HDFC Millenia vs Tata Neu Plus vs Swiggy Credit Card – Best for Rewards?

ICICI Sapphiro vs IDFC Mayura vs HDFC Diners Black – Best Premium Travel Card?

ICICI Sapphiro vs IDFC Mayura vs HDFC Diners Black – Best Premium Travel Card?